The world is changing! Both home sellers and buyers need to stay current as the real estate market morphs. For example, what should the role of electronics be in a modern home? What happens to them during a power outage? (Are they even usable?) Which deficiencies do I really need to be concerned with? Are there recent changes in disclosure laws that affect real estate transactions? The bottom line is wrapped up in safety. First, safety of your life and limb for loved ones (as a buyer looking for a home) and secondly, the safety of your investment and its eventual sale (i.e., owners seeking a top price). And buyers, don’t forget that… one day, what is now a purchase will probably someday be a sale for you.

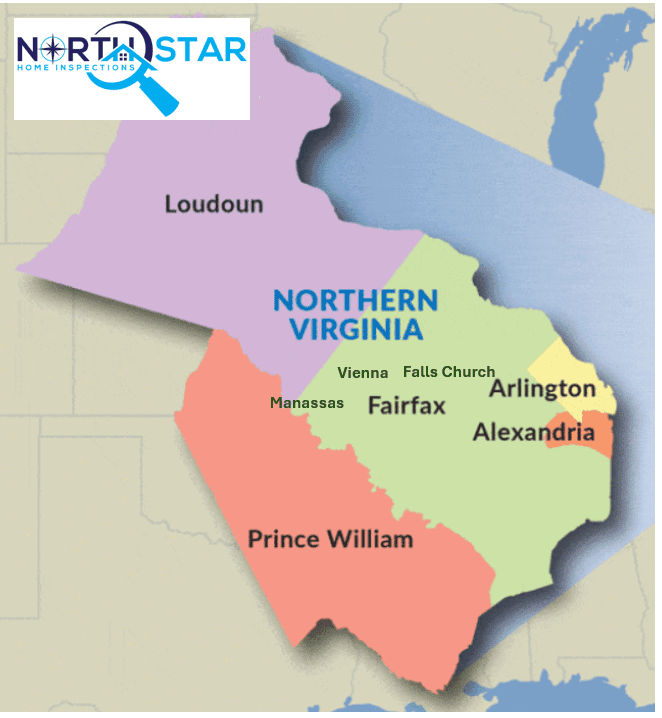

At North Star, we are passionate about and focused on the preservation of safety for these two domains. We will provide guidance to our clients as they balance the many factors in a real estate transaction. Just as an insurance policy reduces overall risk and preserves an asset’s value for all parties concerned, so does a thorough home inspection. For the seller, do you want to discover…at the last moment that deficiencies are now holding up the process (forcing you to come up with cash or more time to close the deal)? For the buyer, don’t you want to know what you’re buying, even if you accept certain deficiencies (as many do)? Are they sized at $200, $2000, 20,000 or $200,000? Investors also must legally provide for a safe tenant living experience in a reasonable and fair manner. With the median price of a home in Northern Virginia at about $730,000* and the inventory of available homes as a relative low point, can you afford to cut corners? Let North Star Home Inspections support your home sale, home acquisition or your property investment with peace of mind.

Harmonia est ex Veritate (i.e., harmony comes from truth).

*Source: Northern Virginia Association of REALTORS (NVAR)

Side note:

This post causes my MBA-trained mind to scream the following question to me: “why would you put an asset worth $730K at risk to save $500 or $600?” You would spend this inspection fee over 1400 times before equaling the cost of the home. Or, put another way, the cost of the inspection is typically *much* less than one one-thousandth of a percent of the home’s value. Do you really want to pinch pennies and create such risk (by foregoing a home inspection)? This is not how large assets are managed. If you did this in a corporate setting, you’d be fired. (food for thought).