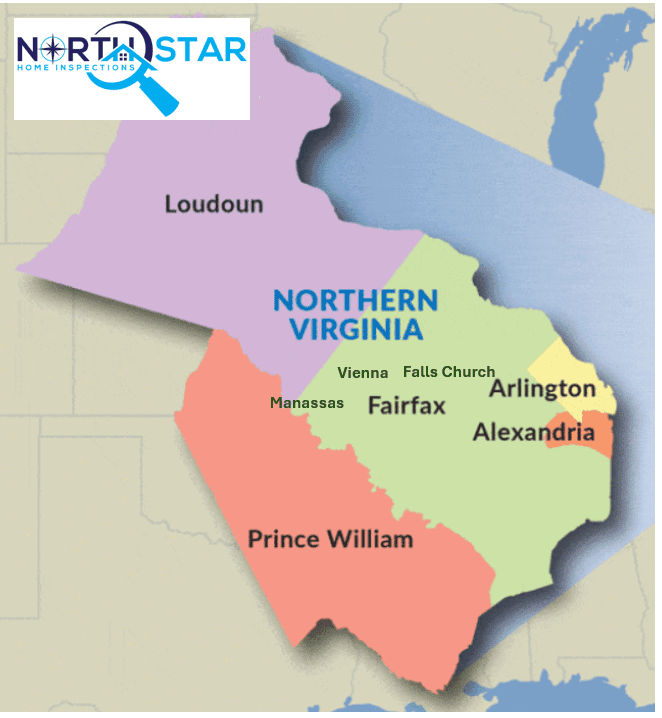

Is Northern Virginia considered a natural disaster risk area? Will you need to pay an elevated homeowner’s insurance premium in order to live in the counties of Loudoun, Prince William, Fairfax and the enclaved cities of northern Virginia?

In a word… no. This region is known to the locals as being exactly what you’d hope for… a stable weather risk and one that is void of any notable wildfires, earthquakes and other primary natural disasters. I am referring to the type known to California, Texas and recently in Hawaii. Although there is an earthquake zone in central Virginia, it is not applicable to the state’s northern counties. And as far as violent summer storms go, we’re on the low end of risk.

There are secondary natural disasters like hailstorms and tornado but this region does not very often suffer with these (in severity or frequency). This is a hot topic for some homeowners in the US as insurance companies update their risk models by zip code and occasionally by individual house. Their models are getting richer with recent disaster data and can more accurately classify regions by risk factor at a level that has more fidelity than in recent years.

This was brought to the surface in a recent Wall Street Journal article (May 1st, 2024) and is very real, for some parts of the country. Since I live and work in Northern Virginia and am not in the insurance industry, I do not have an interest (other than a passing one) in high risk and insurance for natural disasters, so, here is a more relevant question: how can I lower my already low home insurance rate?

Here are a few ideas:

Specifically ask your insurance company how you may do this. You may be able to get a discount if you live very close to a fire hydrant, install a security system or upgrade certain aspects of your home. The way to ask is like this: what qualifies for your absolute best rate? Be sure to shop around. A very prevalent home insurance underwriter in this region is USAA and they have a very loyal client base. If you’re former active or retired military and you have not considered them, you may want to. They are known for good rates. (Personal story: within a few hours they responded very professionally and brought in some experts, on my most recent roof damage incident).

There are other factors that may influence your shopping criteria, such as the fact that you have never or hardly ever filed claims, your bundling strategy, annual payment vs. monthly or quarterly, or a new renovation to the home. Did you recently turn 65 years old or add smoke alarms to a portion of your home or install a new roof? What about security locks, etc. Did you know that Alexandria homes—built recently, must have sprinkler systems? These all may affect your premium. Do you have multiple homes that could be brought under one company? If you work for a large employer, do they have affiliations with any national insurance carriers? Could one be created?

The key is to think out of the box and never accept their first offer without asking questions.