Thankfully, all markets ebb and flow; real estate is especially prone to seasons of price increases and declines; if you’re patient, you can synchronize your first-time home purchase (or any home purchase) during a season of price dips.

Admittedly, this past summer was nuts… the perfect storm occurred: a) low inventory of available homes for sale, b) major adjustment in how Realtors are compensated and c) intertest rates that simply made it difficult for buyers and sellers to act upon their plans.

These conspired to make it very challenging for first time buyers. Add to all of this, the fact that the quantity of jobs grew in Northern Virginia so, this simply increased the need for quality housing, too. For example, the quantity of available jobs in Virginia are, on-average, 4.3% higher than four years ago (and approximately 800K since 2000), while they are flat in Maryland and even negative in the District of Columbia–certainly made Northern Virginia much more competitive.

Nationally, however, there is some good news: quoting www.realtor.com …

“signs that a more buyer-friendly market might be on the horizon (even though mortgage rates are on the rise again after plunging last month). That’s because in more than half of the 50 largest markets in the U.S., median list prices have decreased year over year—in one case by more than 12%, according to the Realtor.com® September Housing Market Report.”

In Northern Virginia, specifically, there are also signs of an improving market. The Northern Virginia Association of Realtors (NVAR) convened for our annual meeting (i.e., the author is a member) during October and here are a few take-aways from the keynote speaker, Dr. Lawrence Yun, chief economist with the National Association of Realtors:

- Generally, conditions in 2025 will be better than 2024;

- Generally, conditions in 2026 will be better than 2025;

- (Nov. 2024) Interest rates are trending to an average of 6.3%, down from near 8% just one year ago;

- Pressure will remain on the Federal Reserve and the executive branch to keep these headed lower.

- Median income required to purchase home in No. America is declining–at least slightly; yes, Northern Virginia will always require a higher income, relative to all of North America, but the pressure is supportive;

- The Quantity of Pending Contracts (home sales) are at a 22-year low; this means that in 2025, there may exist a pent-up need for owners to sell (on top of the normal motivations: e.g., growing families, marriage, divorce, retire-to-the-country, owners die, switch jobs, etc.);

- Those homes that did not sell in 2024, that perhaps would haves sold, in a normalized market, may come back on to the market at a lower sale price, during 2025 now that prices are not peaking.

- There is longer-term pressure for a “recovery” in the R.E. market. Northern Virginia has already witnessed a 4.6% increase year-over-year in quantity of home sales (2024 vs. 2023).

- Builders have seen an uptick in their planning and activity for new home construction;

- There will be pressure applied by the NAR on the new Executive Branch administration (i.e., during 2025) to increase the taxpayer exemption for home appreciation ($250K for single filers, $500K for married) since this amount was arrived-at 25 years ago. It would be reasonable to double both of these figures if we simply adjusted for inflation. In so doing, virtually all home sellers have a much lower or nonexistent tax implication for selling, which increases (i.e., some resisted selling because the realized appreciation exceeded the amounts above).

- The very generalized trend of 5% appreciation in residential real estate–over the long term, is intact.

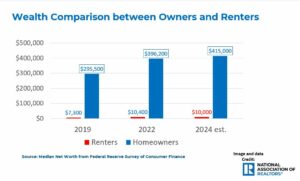

- When it comes to wealth creation, there is a staggering and positive difference between renters vs. homeowners: on average, owners are 41-times more likely than renters, to build wealth. Don’t give up!

- Rural Residential (as opposed to urban or suburban) real estate is still a viable option for many citizens; many employers understand remote productivity and allow this at a rate unlike pre-COVID crisis. Impact: Some are more likely to buy a home outside the urban centers if they’re able to commute only 2 or 3 days per week.

- In 2025, there may be incentives applied to the investor community to sell to first time buyers more aggressively;

The net result is that if you’re in the market for a home, especially in Northern Virgina, you should prepare for Spring 2025 …and be ready. Market conditions will be better than in 2024 for those who are prepared and for those who have done some homework.

For a free consultation, contact Dan at dan@northstar-homeinspections.com